BroadBand Security (PCI DSS Service)

PCI DSS stands for Payment Card Industry Data Security Standard. It is a security information standard established by 6 major card companies, including Visa, MasterCard, American Express, Discover, JCB, and UnionPay. Its purpose is to assist organizations, companies, and businesses that accept credit card payments in preventing fraud resulting from credit card transactions by controlling standards for card data storage, processing, and transmission. Credit card brands other than these 6 are not covered by the PCI DSS standards. This standard is governed by the Payment Card Industry Security Standards Council.

Which the examination of this standard will take place every year by independent auditor (Qualified Security Assessor (QSA))

✪ Ref: www.omise.co

Why PCI DSS is Important to you?

PCI DSS purpose is to protect card data from attackers and perpetrator. You can keep your data secure, avoiding costly data breaches, and protecting your employees and your customers in compliance with PCI DSS requirements.

THE KEY STRENGTH OF BBSEC

LANGUAGE SUPPORT

ENGLISH / JAPANESE KOREAN / THAI

PCI DSS MARKET

KOREA NO.1 JAPAN NO.3

CONSULTING

KNOW-HOW

MARKET EXPERIENCE

SOUTHEAST ASIA

CENTRALIZED

ASSESSMENT BACK DATA

VARIOUS ENTERPRISE

LEVEL ASSESSMENT EXPERIENCE

BBSEC PROFESSIONAL RESOURCES

CISSP 18

CISA 22 CGEIT 1 CRISK 1 CISM 11

CPSA 4 QSA 31 3DS 2 AQSA 6 P2PE 2

GCFA 2 GCIH 1 GCFE 2

PCI‐DSS Compliance Process

Gap Analysis

- Document review - Manager interview - PAN data flow check - Report on base in analysis

Scoping & Structuring

- Scoping assessment area - System improvement - Process, Policy improvement - Review and update documents

3. On‐site Assessment

- On-site assessments - ROC (Report on Compliance) - AOC (Attestation of Compliance)

PCI DSS Certification

- PCI DSS Compliance and practices to maintain the process in accordance with standards for the next audit

PCI CPSA

Card Production Security Assessor (CPSA) is security organizations that have been qualified by the Council to validate an entity’s adherence to the PCI SSC.

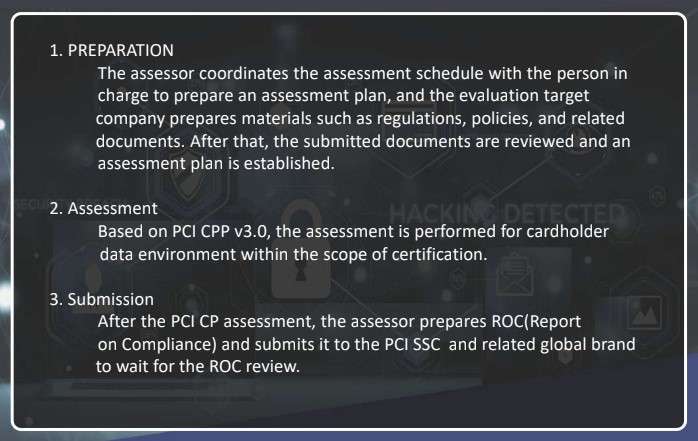

The PCI CPSA assessment process

Card Production Logical Security and/or Physical Security Standards will cover systems, business processes, and activities associated with card production and provisioning.

CP SECURITY ASSESSMENT WHICH COVER

- Card Manufacturing

- Chip Embedding

- Personalization

- Fulfillment

- Mailing

- Packaging

- Shipping

- Storage

- PIN Printing

- HCE

The assessment process

PREPARATION

- Physical / Logical environment inspection - Preparation and defining the scope - Brand compliance verification - Current ROC check and schedule adjustment

ASSESSMENT

- On‐site Assessment - Standard documentation process - Compliance list check - Assessment report

SUBMISSION

- ROC & AOC report - Report quality guaranteed by QA team - Submit document

BroadBand Security is your trusted service source for finding your difficulties in any data breach. The BBSec professional competence is all yours.

BBSec SWIFT Service

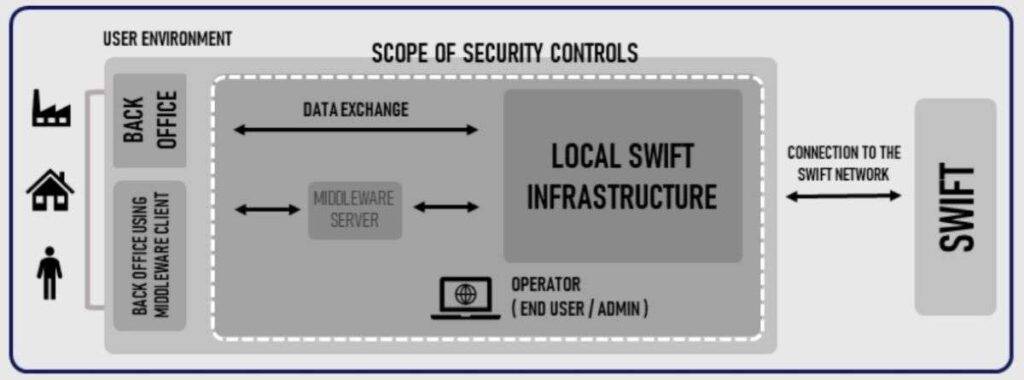

SWIFT is a global membership association for financial institutions to realize international settlement . SWIFT provides a financial messaging format standard and platform for messaging, currently used by more than 11,000 entities in more than 200 countries and territories .

The ability of the SWIFT system can send more than 40 million messages per day. Supports multi-trillion dollar money transfer exchanges. both between the business sector as well as between the governments of each country.

Entities using this SWIFT are required to conduct an external or internal assessment annually to ensure they meet the requirements of the SWIFT CSCF ( Customer Security Control Framework ) . As the first Japanese (domestic) company to be certified as a CSP assessment provider , BBSec utilizes the know-how we have cultivated so far to support SWIFT CSCF compliance for domestic and overseas business entities.

BBSec registered in Swift partner program to provide the consult with international qualifications such as QSA and CISSP as well as consultants with high IT skills will support your compliance. With the scope of compliance as follows.

SWIFT ASSESSMENT PROCESS

ONSITE ASSESSMENT

CHECK CONFIGURATION OF SWIFT INFRA AND NETWORK - CONFIRM SWIFT ASSESSMENT SCOPE - INTERVIEW, CHECK DOCS AND DEVICES - CHECK REQUIRED CONTROL IS SATISFIED

LIST REMEDIATION

AFTER THE ASSESSMENT SWIFT CSCF IS SATISFIED ALL OK - NOT SATISFIED THEN REMEDIATION REQUIRED - REMEDIATION ACTION BY CLIENT THEN CONFIRM - SWIFT EXTERNAL ASSESSMENT REPORT

SWIFT REVIEW SUPPORT

IF ADDITIONAL ACTION REQUIRED ON THE EXTERNAL REPORT - VERIFY AGAIN THE REQUIRED CONTROL - NEEDS WITHIN 6 M AFTER ASSESSMENT - NOTIFY RESULT TO CLIENT AND SWIFT

Strengh of BBSec on SWIFT Assessment

COMPREHENSIVE

CONSULTING SOLUTION AUDITING

OVERALL QUALITY

DEDICATE QA TEAM VISUALIZATION PEER REVIEW

PROFESIONALITY

QUALIFIED CERTS MANY SPECIALISTS YEARS EXPERIENCE

REASONABLE PRICE

LOCALIZED PRICE TRAVEL FEE INCL. ADVISORY

BBSec Services

☑ PCI DSS ☑ PCI CPSA ☑ SWIFT ☑ PDPA ☑ Consulting

BBSec Services Languages

🅰 English 🅰 Japanese 🅰 Korean 🅰 Thai